News Archive-2011

Nov 29, 2011

Fall 2011: GCER’s Featured Research Profile.

Junior, the Risky Investment, Grandma, the Insurance Contract, and other bedtime stories as told by Gete and Porchia.

Children are sources of costs and benefits, both monetary and non-monetary. For these reasons, economists have studied children as “assets” since the path-breaking work of Nobel Prize winner Gary Becker. However, GCER Faculty Fellow Pedro Gete and co-author Paolo Porchia claim in their recent paper “Fertility and Consumption when Having a Child is a Risky Investment” that the fertility literature is missing an important element: children are risky assets.

Children are sources of costs and benefits, both monetary and non-monetary. For these reasons, economists have studied children as “assets” since the path-breaking work of Nobel Prize winner Gary Becker. However, GCER Faculty Fellow Pedro Gete and co-author Paolo Porchia claim in their recent paper “Fertility and Consumption when Having a Child is a Risky Investment” that the fertility literature is missing an important element: children are risky assets.

The risk comes from a variety of sources. A would-be parent cannot precisely forecast the cost of raising a child (presumably such costs would include the opportunity cost of the parents’ time and the effects on their career paths) or the benefits that a child will provide. A parent cannot predict, for example, how often her children will get sick, how much money and time it will cost to treat an illness, whether the child will need extra support at school or instead gets a full scholarship to go to Harvard, or whether her child becomes a successful actor who brings in millions of dollars to the family. Moreover, insurance markets for many of the aforementioned contingencies, especially those related to the time costs for the parents, do not exist. As risky assets, children are at most partially insurable. Consequently, childbearing adds another source of risk to households.

Gete and Porchia study the consequences of fertility and consumption, taking into account that children are a source of risk that interacts with other risks borne by the parents. They develop a model in which the decision to have a child is comparable to the decision to exercise a financial option. In the model, a household has an initial wealth and every period receives some stochastic income (assumed exogenous for simplicity). The household gets utility from consumption and can save at a risk-free rate. Moreover, she can decide to have a child or postpone the decision. If the household has a child then she is acquiring an irreversible, durable, and non-tradable asset that gives her non-stochastic utility but implies some stochastic exogenous costs. These uncertain costs can be correlated with income and are not insured by financial markets.

Gete and Porchia establish several new theoretical results: i) Higher cost volatility diminishes fertility and consumption. Intuitively, risk-averse households are less willing to invest in riskier assets. Higher risk results in higher precautionary savings. ii) Risk aversion speeds up fertility and lowers consumption. This happens because a child is a safe source of utility (for example, parents know that they will enjoy playing with their children). This safe utility flow is an important characteristic of children when we think of them as an asset class. It pushes the household for early fertility to enjoy the children as an insurance mechanism against fluctuations in consumption. iii) Fertility is increasing in the correlation between income and child cost shocks. The household is reluctant to have children when positive cost shocks come together with bad income shocks (for example, households for whom child illnesses imply reduced hours of work, and this has negative consequences for the parents’ careers). A pro-natalist government may encourage fertility by altering this correlation with policies of State-paid leaves when the child is ill, or by supporting childcare. iv) The sign of the correlation determines whether higher income volatility speeds up or delays fertility, although the effect decays with risk aversion. Households with volatile earnings will have more children if children hedge income shocks (for example, having a child increases the likelihood of receiving a subsidy when the parent is unemployed).

Finally, to motivate the empirical appeal of the theory, Gete and Porchia identify a variable that can serve as a proxy for child cost risk: the distance of the grandparents to the parents. They assume that households whose parents live close by face less uncertainty from the time cost shocks associated with raising a child. They show that this variable is a highly significant predictor of the likelihood of childbearing. The higher the distance between the parents the smaller the likelihood of childbearing. Distance is significant also when controlling for variables commonly associated with the fertility decision, such as income, wealth, income over wealth, age of the householder, race, religion, and education. Hence, when financial markets do not insure the risks associated with child-rearing, an available grandparent turns out to be an excellent insurance contract.

November 9, 2011

David Card to give GU Razin Policy Lecture on April 17, 2012.

GCER is pleased to announce that David Card, the Class of 1950 Professor of Economics at UC Berkeley, will present the 2012 Razin Policy Lecture at Georgetown University.

GCER is pleased to announce that David Card, the Class of 1950 Professor of Economics at UC Berkeley, will present the 2012 Razin Policy Lecture at Georgetown University.

This year’s Razin Lecture is entitled “Social Interactions” and takes place on Tuesday, April 17, 2012, at 4:00 pm in the BSB 490 Fisher Colloquium.

Professor Card was honored by the American Economic Association in 1995 with the John Bates Clark Medal. More he received the Frisch Medal in 2007 for an outstanding research paper (with D. Hyslop) published in Econometrica in 2005, and the IZA Prize in Labor Economics in 2006, from Germany’s Institute for the Study of Labor, the leading award for labor economists. David Card’s research spans a wide range of issues and problems in labor economics. His research topics include the effect of minimum wage, the impacts of immigration, the consequences of racial segregation, and the effects of policy changes on health insurance utilization and on health. Card’s most recent work studies peer effects and inequality in the workplace.

Sep 10, 2011

John Rust to join GCER and GU Econ Faculty.

The Georgetown Department of Economics and Center for Economic Research is very pleased to announce that John Rust will be joining the department in the Fall of 2012 as Professor and GCER Faculty Fellow. Rust will be moving over to Georgetown from the University of Maryland where he has resided as a Professor of Economics since 2001.

The Georgetown Department of Economics and Center for Economic Research is very pleased to announce that John Rust will be joining the department in the Fall of 2012 as Professor and GCER Faculty Fellow. Rust will be moving over to Georgetown from the University of Maryland where he has resided as a Professor of Economics since 2001.

Rust’s research is internationally renowned and spans both the technical frontier and the practical side of economics. He is best known for his research on the development of computationally tractable methods for solving and estimating models of dynamic decision-making under uncertainty. In a series of widely acclaimed publications Rust demonstrated that these discrete dynamic programming models provide accurate predictions of actual human decision-making in a variety of contexts. Along the way, he pioneered new algorithms for solving these problems, attracting the attention of leading computer scientists and mathematicians working in the field of computational complexity as well as the economists working in this field.

Rust has received numerous awards for his research. He was awarded an Alfred Sloan Fellowship in 1988 and a fellowship at the Hoover Institution at Stanford in 1991. He was elected as a Fellow of the Econometric Society in 1993 and became a fellow of the TIAA-CREF Institute (the largest retirement fund for college professors) in 2003. In 1997, Rust received the Ragnar Frisch Medal from The Econometric Society for his first empirical application of the method in the paper, “Optimal Replacement of GMC Bus Engines: An Empirical Model of Harold Zurcher.”

Rust has been on the editorial board of numerous journals including serving as an Associate Editor at Econometrica and co-editor of the Journal of Applied Econometrics. He has been a consultant to the U.S. Social Security Administration and a member of the Long Term Modeling Advisory Panel at the Congressional Budget Office. He has served as a member of the Economics Panel of the National Science Foundation and the Committee on National Statistics of the National Academy of Science, as a member of the Panel on Retirement Income Modeling, and served as an advisor to the Steering Committee that advised on the design of the Health and Retirement Survey (HRS).

Most recently Rust has served as a member of the Technical Advisory Panel to the Social Security Advisory Board, and a consultant to the Social Security Administration on long-term policy modeling via a research contract between SSA and the Urban Institute.

Rust received his Ph.D. from MIT in 1983, specializing in applied econometrics. He held previous faculty positions, first at the University of Wisconsin from 1983 to 1995, and then at Yale from 1996 to 2001. In all his faculty appointments, he has been a Professor of Economics since 1990.

Aug 15, 2011

GCER and GU Faculty Welcome Pedro Carneiro as the newest Faculty Fellow.

Georgetown Department of Economics and Center for Economic Research welcomes its newest member, Pedro Carneiro who now joins the Department and GCER in the Fall of 2011. Carneiro arrives from University College London where he currently holds the rank of Reader, and will hold the rank of Associate Professor at Georgetown.

Georgetown Department of Economics and Center for Economic Research welcomes its newest member, Pedro Carneiro who now joins the Department and GCER in the Fall of 2011. Carneiro arrives from University College London where he currently holds the rank of Reader, and will hold the rank of Associate Professor at Georgetown.

Carneiro comes to GCER with an outstanding record of scholarship and expertise in the areas of labor economics and applied microeconometrics. His research focuses on human capital development, that is, the ways in which individuals acquire the skills that determine their earnings potential. These include early childhood development, education, and on-the-job training.

Carneiro has much-cited publications in Econometrica and The American Economic Review among other highly respected outlets. His work figured prominently in a number of areas. One paper, in particular, that has received much attention was co-written with James Heckman and concerns heterogeneous treatment effects. A policy designed to increase college attendance, for example, can have a strong effect on some parts of the target population but weak (or even negative) effects on other parts of that population. For many purposes, it is important to be able to estimate the distribution of treatment effects. Carneiro and Heckman use a “latent factors” approach to estimate the heterogeneous treatment effects, and this approach is now considered to be a major methodological innovation in the field.

Carneiro received his Ph.D. at the University of Chicago in 2003. After completing his Ph.D., he joined the faculty of University College London.

Aug 5, 2011

GCER Economist interviewed on Fed Policy in a recent WSJ Article.

GCER Economist and former Fed Monetary Affairs Director Brian Madigan was interviewed by The Wall Street Journal in an August 2nd article on Federal Reserve Bank policy. Madigan, along with other recent Monetary Affairs directors Donald Kohn and Vincent Reinhart, signaled support for a new Fed bond purchase program if inflation slows and the economy continues its recent slowdown.

GCER Economist and former Fed Monetary Affairs Director Brian Madigan was interviewed by The Wall Street Journal in an August 2nd article on Federal Reserve Bank policy. Madigan, along with other recent Monetary Affairs directors Donald Kohn and Vincent Reinhart, signaled support for a new Fed bond purchase program if inflation slows and the economy continues its recent slowdown.

June 23, 2011

Spring/Summer 2011. GCER Featured Research Profile.

Ludema, Mayda, and Mishra show that when firms talk, governments listen.

How do firms obtain favors from the government? The usual answer is, by spending money, though debate rages in the literature about what kind of spending, lobbying expenditures or campaign contributions, is more important. GCER faculty fellows Rodney Ludema and Anna Maria Mayda, along with IMF economist, Prachi Mishra, challenge this spending-centered view in their recent paper, “Protection for Free? The Political Economy of U.S. Tariff Suspensions.” They study the political influence of individual firms on Congressional decisions to suspend tariffs on U.S. imports of intermediate goods.

Ludema, Mayda, and Mishra develop a model in which firms influence the government by transmitting information about the value of protection, using verbal messages and political spending. They estimate this model using firm-level data on tariff suspension bills and political spending from 1999-2006 and find that indeed verbal opposition by import-competing firms, even without spending, significantly reduces the probability of a suspension being granted. They further find that spending by the proponent and opponent firms sway this probability in opposite directions. The effect of verbal opposition is substantially larger than that of both opponent and proponent spending. This is explained by a combination of two factors: verbal opposition conveys more information than opponent spending does, and the government values the harm to opponents more than the gain to proponents.

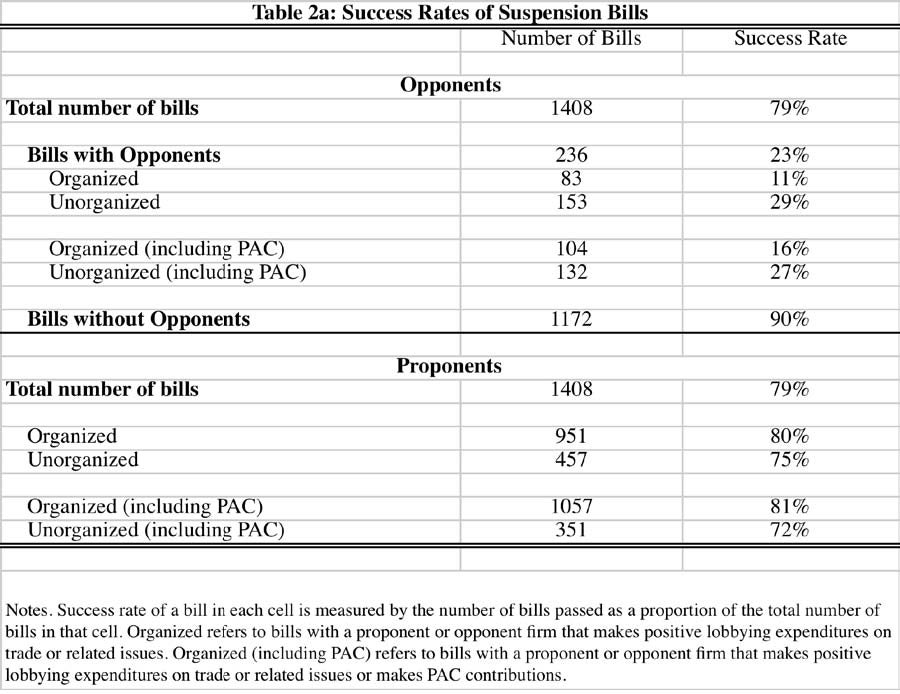

The table below is taken from the paper and shows how the success rates of bills depend on the actions of the firms. The overall success rate of suspension bills is 79%. If the proponent of the bill is an “organized” firm (defined as one that makes positive lobbying expenditures), the success rate is 80%, whereas if it is unorganized, it is only 75%. If the definition of organization is expanded to include positive PAC contributions in addition to lobbying, the success rates are 81% and 72%, respectively. If a bill is unopposed the success rate is 90% on average. The success rate drops to a mere 29% if the bill is opposed by an unorganized domestic firm (27% under the PAC definition) and only 11% if the opponent is organized (16% with PAC). Thus, while the presence of a political organization effect is in line with expectations, this effect appears to be much smaller than the effect of verbal opposition.

Jun 10, 2011

Inaugural GCER Alumni Conference held at Georgetown.

Keynote Speaker Carmen Reinhart Presents Data on “Financial Repression” The Inaugural GCER Alumni Conference was held on June 2-3 at Georgetown University. The conference, organized largely by former Ph.D. students from Georgetown, featured research presented by many prominent economists including former Georgetown students who now hold faculty and scholarly positions at universities and research institutions worldwide. The conference’s Keynote speech was delivered by Professor Carmen M. Reinhart, Dennis Weatherstone Senior Fellow at Peterson Institute for International Economics. Professor Reinhart spoke about her latest paper on financial repression which evaluates the consequences of restrictive interest rate policies by governments.

Keynote Speaker Carmen Reinhart Presents Data on “Financial Repression” The Inaugural GCER Alumni Conference was held on June 2-3 at Georgetown University. The conference, organized largely by former Ph.D. students from Georgetown, featured research presented by many prominent economists including former Georgetown students who now hold faculty and scholarly positions at universities and research institutions worldwide. The conference’s Keynote speech was delivered by Professor Carmen M. Reinhart, Dennis Weatherstone Senior Fellow at Peterson Institute for International Economics. Professor Reinhart spoke about her latest paper on financial repression which evaluates the consequences of restrictive interest rate policies by governments.

Apr 13, 2011

Harvard and NYU Scholars to be featured speakers at Annual Mini-Conference on Political Economy.

Professor Pande

Professor Pande

Professor Wantchekon

Professor Wantchekon

The Annual Mini-Conference on Political Economy will take place on Wednesday, April 27 from 2:30 pm – 5:30 pm in the Mortara Center for International Studies, 3600 N Street. This year’s talks are: “Do Informed Voters Make Better Choices? Experimental Evidence from India,” by Rohini Pande, Mohammed Kamal Professor of Public Policy, Harvard Kennedy School of Government. “Deliberative Electoral Campaigns and Transition from Clientelism: Evidence from Benin,” by Leonard Wantchekon, Professor of Politics and Economics, New York University. The event is jointly sponsored by GCER, the Departments of Economics and Government, and the School of Foreign Policy. For further details, see GCER’s Monthly Calendar.

Mar 27, 2011

Esther Duflo to Speak on “Poor Economics” at Georgetown in April.

Esther Duflo, a development economist at MIT and one of the leading experts in the field of program evaluation will speak about her new book Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty on April 26.

Esther Duflo, a development economist at MIT and one of the leading experts in the field of program evaluation will speak about her new book Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty on April 26.

The Lecture, Reception, and Book Signing take place on Tuesday, April 26, from 12 noon – 2:00 p.m. in the Rafik B. Hariri Building (Business School).

Mar 26, 2011

ECB Board Member Defends the Euro in Georgetown Economics Conference.

In a panel hosted by GCER’s Matthew Canzoneri, European Central Bank Executive Board member Jose Manuel Gonzalez-Paramo defended the Euro at a recent conference on the Spanish economy held at Georgetown University.

The event was picked up by many in the financial press, including Reuters, The Wall Street Journal, and Bloomberg.

Mar 5, 2011

Tenth Carroll Round Schedule Announced.

Last year’s Carroll Round participants The Carroll Round, the only undergraduate conference for International Economics, is hosted annually at Georgetown University and will be held Thursday, April 14 through Sunday, April 17 this year. The conference provides top undergraduate students from around the world the unique opportunity to present and discuss their research with other students, professors, and policy-makers. This year’s featured speakers are Prof. Jeffrey Sachs, Nobel Laureate Joseph Stiglitz, and Prof. Jagdish Bhagwati. For further information about the conference, please visit Carroll Round.

Last year’s Carroll Round participants The Carroll Round, the only undergraduate conference for International Economics, is hosted annually at Georgetown University and will be held Thursday, April 14 through Sunday, April 17 this year. The conference provides top undergraduate students from around the world the unique opportunity to present and discuss their research with other students, professors, and policy-makers. This year’s featured speakers are Prof. Jeffrey Sachs, Nobel Laureate Joseph Stiglitz, and Prof. Jagdish Bhagwati. For further information about the conference, please visit Carroll Round.

Feb 15, 2011

Research by GCER Fellow William Jack featured in NY Times Freakonomics Blog.

A new paper by GCER Fellow William Jack and co-author Tavneet Suri of MIT examining mobile banking in Kenya was recently featured in the NY Times Freakonomics Blog. This is the second time that Jack’s research on Kenya was picked up by the popular NY Times blog. The first was reported last year on a field experiment by Jack and co-author James Habyarimana of Georgetown GPPI, examining the effect of informative posters on Kenyan traffic fatalities.

Jan 20, 2011

“Exchange Rate Dynamics”, by GCER Fellow Martin Evans.

“Exchange Rate Dynamics”, by GCER Fellow Martin Evans.

Exchange-Rate Dynamics by Martin Evans, GCER Research Fellow and Professor of Economics at Georgetown University. Published by Princeton University Press & forthcoming in 2011.

From the Princeton U. Press website: “Variations in the foreign exchange market influence all aspects of the world economy, and understanding these dynamics is one of the great challenges of international economics. This book provides a new, comprehensive, and in-depth examination of the standard theories and latest research in exchange-rate economics. Covering a vast swath of theoretical and empirical work, the book explores established theories of exchange-rate determination using macroeconomic fundamentals, and presents unique micro-based approaches that combine the insights of microstructure models with the macroeconomic forces driving currency trading.” (Read more from the PUP site ).

January 6, 2011

Bachmann and Bai examine the effects of wealth bias in the policy process.

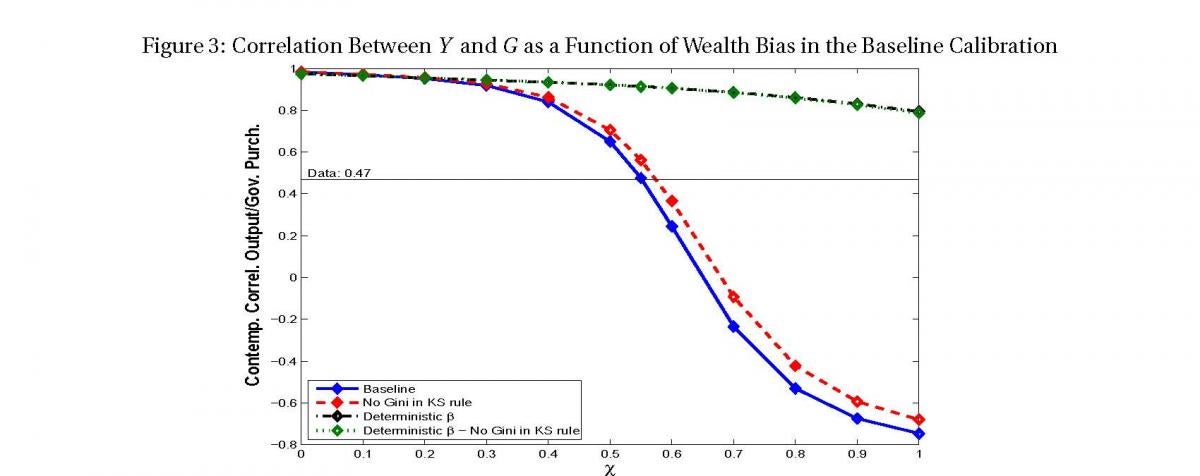

In their paper, “Government Purchases Over the Business Cycle: the Role of Economic and Political Inequality (GCER Working Paper, 2010),” Ruediger Bachmann and Jinhui H. Bai explore the implications of economic and political inequality for the business cycle comovement of government purchases in the U.S. They conduct their quantitative experiments in a standard model of economic growth in which public expenditures financed by income taxes are determined by the political process. A key feature of their study is a wealth bias in the political process that disproportionately weighs the clout of upper-income groups. Increases in income inequality, therefore, lead to increased political inequality. The analysis shows a negative correlation between wealth bias and the degree of business cycle comovement of government purchases. The estimated wealth bias that matches the observed mild procyclicality of government purchases in the data, is also consistent with cross-sectional survey data on political participation.

In their paper, “Government Purchases Over the Business Cycle: the Role of Economic and Political Inequality (GCER Working Paper, 2010),” Ruediger Bachmann and Jinhui H. Bai explore the implications of economic and political inequality for the business cycle comovement of government purchases in the U.S. They conduct their quantitative experiments in a standard model of economic growth in which public expenditures financed by income taxes are determined by the political process. A key feature of their study is a wealth bias in the political process that disproportionately weighs the clout of upper-income groups. Increases in income inequality, therefore, lead to increased political inequality. The analysis shows a negative correlation between wealth bias and the degree of business cycle comovement of government purchases. The estimated wealth bias that matches the observed mild procyclicality of government purchases in the data, is also consistent with cross-sectional survey data on political participation.

This effect is illustrated in the graph below where increases in the wealth bias of the policy-making process can be seen to dampen the correlation between income and purchases.