News Archive: 2016

Dec 12, 2016

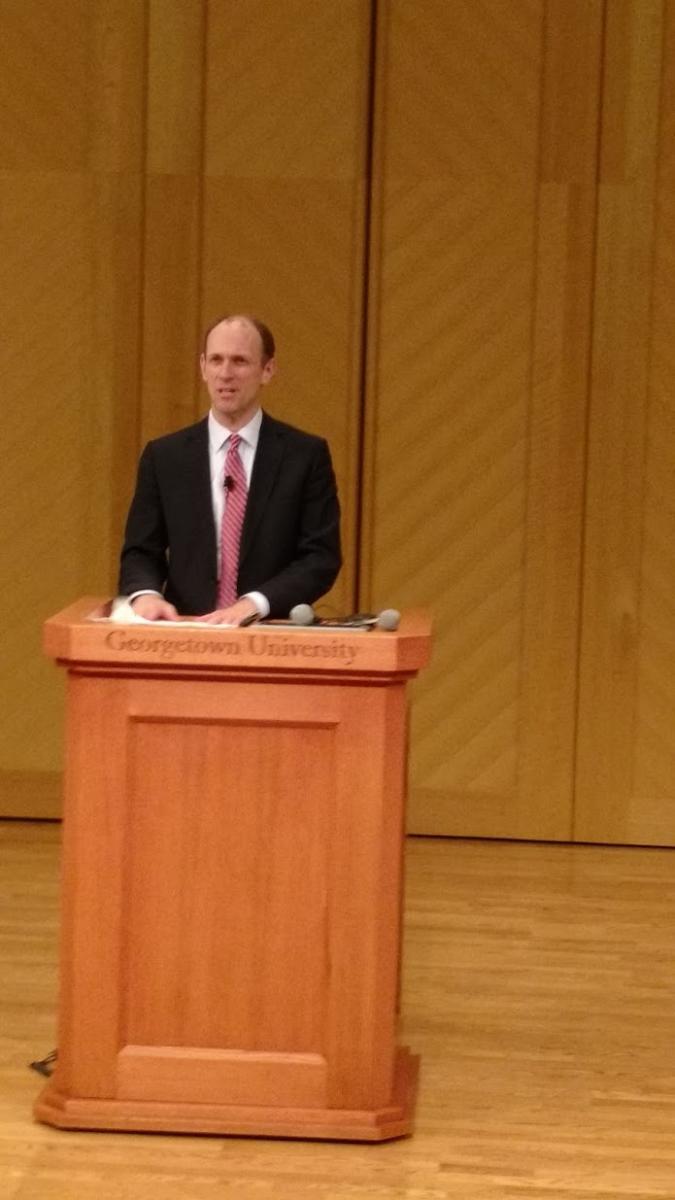

Professor Billy Jack in Science

Professor Billy Jack recently published an article in Science, which shares the analysis of data collected over a six-year period in Kenya that has revealed that the country’s mobile money platform, M-PESA, has lifted nearly 200,000 households out of poverty. The effects of this form of digital financial inclusion are particularly strong for female-headed households, with an estimated 185,000 women moving from agriculture to business as their primary occupation as a result of the expansion of mobile money. The study, conducted by Tavneet Suri at MIT Sloan with Billy Jack from Georgetown’s Department of Economics, appears in the current issue of Science Magazine. For the full article that was posted on Georgetown University’s website, please click here.

Professor Billy Jack recently published an article in Science, which shares the analysis of data collected over a six-year period in Kenya that has revealed that the country’s mobile money platform, M-PESA, has lifted nearly 200,000 households out of poverty. The effects of this form of digital financial inclusion are particularly strong for female-headed households, with an estimated 185,000 women moving from agriculture to business as their primary occupation as a result of the expansion of mobile money. The study, conducted by Tavneet Suri at MIT Sloan with Billy Jack from Georgetown’s Department of Economics, appears in the current issue of Science Magazine. For the full article that was posted on Georgetown University’s website, please click here.

Oct 27, 2016

Professor Alan Krueger to deliver the 2017 Razin Lecture

Alan Krueger, Bendheim Professor of Economics and Public Affairs at Princeton University will deliver the 2017 Razin Policy Lecture on April 24. The Lecture will take place on Monday, April 24, 2017 from 4:00 to 6:00 on the Georgetown University campus. A reception will follow.

Alan Krueger, Bendheim Professor of Economics and Public Affairs at Princeton University will deliver the 2017 Razin Policy Lecture on April 24. The Lecture will take place on Monday, April 24, 2017 from 4:00 to 6:00 on the Georgetown University campus. A reception will follow.

Professor Krueger’s research has included: a study showing that minimum wage hikes can be associated with increased low-skill employment; predictions about who becomes a terrorist; proposals to create national “well-being” accounts to complement measured GDP; a demonstration that graduates of selective colleges (Georgetown?) do not earn higher incomes than similar graduates of less-selective colleges; evidence that computers have contributed to growing income inequality; evidence that economic growth does not necessarily degrade the environment; a paper about the music industry called “Rockonomics”; and much, much more.

While not at Princeton, Professor Krueger has served as Chairman of President Obama’s Council of Economic Advisers, Chief Economist at the U.S. Treasury during the financial crisis, and Chief Economist of the U.S. Department of Labor.

Oct 20, 2016

Featured Research Profile: Fall/Winter 2016-17

Markets with Search and Matching Frictions: Georgetown economists James Albrecht and Susan Vroman discuss directed search in the housing market.

In textbook economics, the market for a good is in equilibrium when its price “equates supply and demand.” The supply-demand approach is a useful tool, but for many important markets, this framework doesn’t do a good job because of frictions that make it hard for buyers to find suitable sellers and vice versa. Take, for example, the labor market. This is a market in which the “good” being sold (labor services) isn’t standardized, so the notion of a “market-clearing price” isn’t useful. Instead, it takes time and effort for workers to find the right job, and, similarly, employers have to expend time and effort to find the right worker. That is, the labor market is characterized by search and matching frictions. Most of the research of Jim Albrecht and Susan Vroman is focused on developing models to better understand how markets with search and matching frictions work. They have applied their models to several markets, in particular, the labor market and the housing market.

Their most recent published paper focuses on the housing market. Search theory is a natural tool to use to analyze this market: anyone who has bought or sold a house knows that it takes time and effort to find a suitable counterpart on the other side of the market. When a house is listed for sale, the seller posts an asking price. Sometimes houses sell at a price below the asking price, sometimes above, and often exactly at the asking price. What role does the asking price play in the housing market, and, more generally, how are sale prices determined in this market? In “Directed Search in the Housing Market,” published in the Review of Economic Dynamics earlier this year, Albrecht and Vroman, together with co-author Pieter Gautier, analyze these questions by constructing a model in which they assume that sellers have limited commitment to the posted asking price. Commitment is limited in the sense that if only one buyer makes a bona fide offer at the asking price, the seller is obliged to sell at that price. This commitment is typically written into contracts with sellers’ agents. However, if more than one buyer offers the asking price, the sale price can be bid above the posted level, and, of course, if the only the offers received are below the asking price, the seller is free to accept or reject the highest of these. In addition to helping understand the pricing patterns that we see in the data, the model explains how the asking price can signal seller “motivation,” that is., how eager the seller is to make a deal. Buyers observing a variety of asking prices will direct their search so that their expected benefit is the same regardless of the price. Buyers know that there is a tradeoff: a low asking price is appealing but it appeals to many buyers so that the chance of being the highest bidder is small whereas bidding on a house with a high asking price likely means paying more if the buyer has the winning bid but having a greater chance of winning. In equilibrium, Albrecht, Gautier and Vroman find that asking prices can indeed signal seller motivation and that prices draw more buyers to the more motivated sellers, an efficient outcome.

Albrecht and Vroman, together with co-author Bruno Decreuse, are currently working on a search-theoretic model of the labor market in which “phantom” job vacancies affect the rate at which the unemployed find jobs. Phantoms are ads for jobs that have been already filled but not yet removed from online job sites like Craigslist and Monster.com. The unemployed direct their search (decide which listings to pursue) taking the fact that older listings are more likely to be phantoms into account. Albrecht, Decreuse and Vroman show that workers over-apply to relatively new job listings – “over-apply” in the sense that if workers could coordinate their search activity, they would choose to direct more applications towards older listings. The authors also show that phantoms are quantitatively extremely important. In a calibrated version of their model, phantoms account for a substantial fraction of unemployment and an even larger percentage of search frictions.

Oct 11, 2016

GCER congratulates Nobel Laureates of 2016

GCER Congratulates the Economic Science Nobel Laureates of 2016, Oliver Hart (Harvard), and Bengt Holmström,(MIT). The Royal Swedish Academy of Sciences awarded the Prize for their work in Contract Theory. Their work has profoundly shaped economists’ understanding of the role of incentives and property rights. Besides providing essential building blocks for a modern theory of the firm, this year Laureates’ writings have found applications that span from Corporate Finance, to Labor Economics, to the Economics of Prisons. GCER is also proud to note that the Nobel Committee in its Scientific Background Paper cited a contribution co-authored by GCER Fellow Luca Anderlini (Anderlini and Felli, Quarterly Journal of Economics, 1994).

Aug 3, 2016

Former PhD student Justin Pierce publishes paper in AER

A recent GU graduate of the Department of Economics, Justin Pierce, has published a paper in the most recent American Economic Review. The paper “The Surprisingly Swift Decline of US Manufacturing Employment” links a `sharp drop in US manufacturing employment after 2000 to a change in US trade policy that eliminated potential tariff increases on Chinese imports.’ The paper was jointly authored with Peter K. Schott of the Yale School of Management.

A recent GU graduate of the Department of Economics, Justin Pierce, has published a paper in the most recent American Economic Review. The paper “The Surprisingly Swift Decline of US Manufacturing Employment” links a `sharp drop in US manufacturing employment after 2000 to a change in US trade policy that eliminated potential tariff increases on Chinese imports.’ The paper was jointly authored with Peter K. Schott of the Yale School of Management.

Apr 17, 2016

Austan Goolsbee delivers 2016 Razin Lecture

Professor Austan Goolsbee recently delivered the 2016 Razin Lecture. Professor Goolsbee’s talk, “Are We Doomed?”, did what dismal scientists often do, answering the question separately for the short and long runs. The short-run outlook for the US economy is not rosy and unlikely to be rescued by the usual saviors. The Fed cannot set interest rates lower. Exports depend on healthy economies in other countries. Home construction is unlikely to return to pre-bubble levels. And consumers are unlikely to return to the pre-2008 spending levels that were financed by that bubble. Goolsbee’s long-run outlook, however, is less dismal. US productivity and per-capita GDP growth have been steady for decades or centuries, and it’s hard to imagine that whatever the 21st century obstacles to growth might be, that they are more imposing than the flu pandemics, depressions, world wars, and oil crises that characterized the 20th century.

Professor Austan Goolsbee recently delivered the 2016 Razin Lecture. Professor Goolsbee’s talk, “Are We Doomed?”, did what dismal scientists often do, answering the question separately for the short and long runs. The short-run outlook for the US economy is not rosy and unlikely to be rescued by the usual saviors. The Fed cannot set interest rates lower. Exports depend on healthy economies in other countries. Home construction is unlikely to return to pre-bubble levels. And consumers are unlikely to return to the pre-2008 spending levels that were financed by that bubble. Goolsbee’s long-run outlook, however, is less dismal. US productivity and per-capita GDP growth have been steady for decades or centuries, and it’s hard to imagine that whatever the 21st century obstacles to growth might be, that they are more imposing than the flu pandemics, depressions, world wars, and oil crises that characterized the 20th century.

Apr 4, 2016

GCER Fellow Pedro Gete’s paper featured in the Brookings Hutchins Roundup

The Brookings blog of David Wessel selected a new paper by GCER Fellow Pedro Gete. The paper concerns the distributional implications of federal mortgage guarantees. It shows that by removing guarantees from the mortgage market, low- and middle-income households are hurt, while high-income households benefit.

The Brookings blog of David Wessel selected a new paper by GCER Fellow Pedro Gete. The paper concerns the distributional implications of federal mortgage guarantees. It shows that by removing guarantees from the mortgage market, low- and middle-income households are hurt, while high-income households benefit.

Mar 15, 2016

Featured Research Profile: Fall/Winter 2015-16

How (not) to run a bank: Georgetown economist Martin Ravallion examines World Bank successes and failures.

The decade or two after WW2 saw many of the world’s poorest countries gain their independence from Colonial rule, and they were hoping to rapidly become less poor. Economics taught policy makers in those countries that a higher investment rate is crucial to assuring faster economic growth. Being a poor country makes it harder to finance the required investments from domestic savings. Yet rich countries should have ample savings available that might be profitably diverted to this task. In an ideal world, global capital markets could be expected to bridge the gap. But 70 years ago those markets were thin and/or not trusted as a source of finance.

The decade or two after WW2 saw many of the world’s poorest countries gain their independence from Colonial rule, and they were hoping to rapidly become less poor. Economics taught policy makers in those countries that a higher investment rate is crucial to assuring faster economic growth. Being a poor country makes it harder to finance the required investments from domestic savings. Yet rich countries should have ample savings available that might be profitably diverted to this task. In an ideal world, global capital markets could be expected to bridge the gap. But 70 years ago those markets were thin and/or not trusted as a source of finance.

In response, the United Nations Monetary and Financial Conference, held at Bretton Woods in 1944, created the International Bank for Reconstruction and Development (IBRD)—a core component of what came to be known as the World Bank. (The International Monetary Fund was created at the same time.) The essential idea was that the IBRD would borrow money on global markets to lend to developing countries. The Bank’s AAA credit rating (stemming from conservative lending policies relative to its capital) allowed it to lend on favorable terms. An aid-facility (with a large grant component), the International Development Association (IDA), was added in 1960.

Much has changed in the 70 years since the famous Bretton Woods conference. World Bank lending (IBRD+IDA) now represents only about 5% of the aggregate private capital flows to developing countries. In the last 10 years or so there have been prominent calls for radically reforming, or even closing, the institution on the grounds that international capital markets have developed greatly over those 70 years. It is also claimed by some that the Bank’s efforts are wasted due to poor governance in developing countries.

Does the Bank still have an important role? If so, does it fulfill that role, and if not, how might it do better? In a new paper, Professor Ravallion argue that the Bank’s development role today overlaps only partially with its original role, as conceived at the Bretton Woods Conference 70 years ago (Ravallion, 2015). Its role today is complementary to (rather than competing with) the private financial sector, other development banks, and academia. Knowledge-generation is central to that role. Development knowledge has properties of a public good, which the Bank can generate in the process of actually doing development on the ground.

Threats to the Bank’s effectiveness: There is still much appeal to the bundling of knowledge with lending that has been the distinctive feature of the Bank’s operations. But there are a number of threats to the efficacy of this model.

There have been some longstanding concerns that the Bank’s “lending culture” rewards operational staff for the volume of their lending, with only weak incentives for assuring that knowledge is both applied and generated in the lending operations. The pressure to lend influences the Bank’s ability to deliver objective policy advice to client countries, even when it is not welcome politically. Too often the Bank’s “country strategy” essentially mirrors that of the government, which may or may not serve broader long-term development goals.

Another threat is the perception that the Bank’s most powerful shareholders have excessive influence on its operations and policy advice. The U.S. has long been identified in this role, though some other countries have also been keen to have their say. Some critics are concerned (rightly or wrongly) about conflicts of interest when the Bank gives advice to developing countries.

These are threats to the Bank’s effectiveness as a knowledge leader in both the public and private sectors. All parties—both clients in developing countries and private investors—must have confidence that the institution is not pushing lending for its own sake or beholden to a few powerful owners. Only then can the Bank be accepted as the source of the objective policy advice and information that is needed.

Recent organizational changes have made some effort to put knowledge in the driver’s seat by organizing the Bank around a set of sectorally-defined “practices.” In the end the organogram has changed rather little. However, the threats to the Bank’s effectiveness are unlikely to be solved by changing the Bank’s organogram. The incentives of managers and staff also need to change, to assure a better alignment with development goals. (See Ravallion, 2015, for some examples of specific proposals for reform from past Bank staff.)

Knowledge Bank? There has been much rhetoric about the “Knowledge Bank” over the last 15 years, but Professor Ravallion not alone in believing that the reality has fallen short of the rhetoric. There is a chronic and growing underinvestment in the kind of rigorous research that is needed to identify and address pressing development issues—both the constraints on rapid poverty reduction at country level and the global public bads that threaten us collectively (ranging from climate change to pandemics). Research has been under-valued and under-funded.

Granted we still see some high-quality research at the Bank, though not always on high-priority topics. We see more ex-post evaluations today than 20 years ago. However, much does not get evaluated, and what gets evaluated is a non-random subset of all projects, casting doubt on what we learn about the whole. Too often, methodological preferences drive what gets evaluated rather than the knowledge gaps facing policy makers. Alongside this, we see fewer and less rigorous ex ante evaluations, which make explicit a project’s economic rationale—why the project is expected to have a social value justifying its cost.

Three changes are needed: Echoing the observations of others within and outside the Bank, three things need to change:

• First, the Bank needs to be more ambitious in identifying and addressing the most pressing knowledge gaps we face today. Policy advocacy must give way to well-informed and objective country-specific analysis. This can be accommodated within the Bank’s traditional country-lending model.

• Second, the Bank’s lending operations must be driven by knowledge of the binding constraints on poverty reduction in specific country contexts and its analytic capabilities must be brought more systematically into its operations from the outset. The Bank’s knowledge generation efforts must inform the nature of its lending and be informed by that lending—rather than simply serving lending when called upon. This requires quite fundamental changes in staff and managerial incentives and resource allocation within the current structure.

• Third, the Bank’s present country-based model needs to be supplemented by a model with greater capacity for supporting the provision of global public goods. If one was to sit down today to design a mechanism to support the cross-country coordination needed to address shared threats it is unlikely that one would come up with the Bank’s current country-lending model. A new model, or possibly a new institution, is called for.

Mar 14, 2016

Ninth International Research Forum on Monetary Policy Upcoming

The Ninth Biennial International Research Forum on Monetary Policy (IRFMP) will take place at the European Central Bank on March 18-19, 2016. It purpose is to promote the discussion of innovative research on theoretical and empirical macroeconomic issues relevant for monetary policy. The conference is sponsored by the Georgetown Center for Economic Research (GCER), the Euro Area Business Cycle Network, the European Central Bank, and the Federal Reserve Board. More information about the conference can be found here.

Feb 23, 2016

Martin Ravallion receives BBVA Foundation Frontiers of Knowledge Award

It is with great pride that the Economics Department announces that Martin Ravallion, the Edmond D.Villani Professor of Economics, has been awarded a BBVA Foundation Frontiers of Knowledge Award for his research on global poverty. Department Chair Frank Vella said “Martin is a remarkable scholar and his dedication to scholarship and research is an inspiration for all those who encounter him or his work. While his work reflects the academic goals of measuring the extent and understanding the causes of poverty, it is motivated by his greater personal commitment to help those who suffer the consequences of such living conditions. This award is further recognition of the importance and impact of Martin’s work.”

It is with great pride that the Economics Department announces that Martin Ravallion, the Edmond D.Villani Professor of Economics, has been awarded a BBVA Foundation Frontiers of Knowledge Award for his research on global poverty. Department Chair Frank Vella said “Martin is a remarkable scholar and his dedication to scholarship and research is an inspiration for all those who encounter him or his work. While his work reflects the academic goals of measuring the extent and understanding the causes of poverty, it is motivated by his greater personal commitment to help those who suffer the consequences of such living conditions. This award is further recognition of the importance and impact of Martin’s work.”

Feb 15, 2016

GCER Fellows Jack and Habyarimana Implement Mobile Money Project in East Africa

GCER Fellows Billy Jack and James Habyarimana will initiate a project to explore innovations to the M-PESA, a mobile money platform launched in 2007 in Kenya that provides access to basic financial services via individual cell phones. The project, funded by a two-year $3.5 million grant from the Bill & Melinda Gates Foundation, will bring together mobile providers, banks, IT developers, and academics to assess and improve the mobile money system in East Africa.

GCER Fellows Billy Jack and James Habyarimana will initiate a project to explore innovations to the M-PESA, a mobile money platform launched in 2007 in Kenya that provides access to basic financial services via individual cell phones. The project, funded by a two-year $3.5 million grant from the Bill & Melinda Gates Foundation, will bring together mobile providers, banks, IT developers, and academics to assess and improve the mobile money system in East Africa.

Feb 12, 2016

GU Econ Phds’ research on Tax Bunching featured in WSJ article

New research by two recent GU Economics Phd students, Jake Mortenson and Andrew Whitten, is featured in the Wall Street Journal’s online edition. The article, entitled “How Some Americans Hit the Maximum Tax-Refund Sweet Spot” discusses research by Mortenson and Whitten, “How Sensitive Are Taxpayers to Marginal Tax Rates? Evidence from Income Bunching in the United States.” In the paper, Mortenson and Whitten use tax return data to document how reported incomes on tax returns tend to be bunched at the break points in the federal tax code. Their results quantify the way in which discrete jumps in marginal tax rates alter the behavior of households.

Jan 12, 2016

Professor Austan Goolsbee to deliver the 2016 Razin Lecture

Austan Goolsbee, the Robert P. Gwinn Professor of Economics at the University of Chicago’s Booth School will deliver the 2016 Razin Policy Lecture on April 6. The Lecture will take place on Wednesday, April 6, 2015 from 3:30 to 5:00 in the Lohrfink Auditorium on the GU campus. A reception will follow.

Austan Goolsbee, the Robert P. Gwinn Professor of Economics at the University of Chicago’s Booth School will deliver the 2016 Razin Policy Lecture on April 6. The Lecture will take place on Wednesday, April 6, 2015 from 3:30 to 5:00 in the Lohrfink Auditorium on the GU campus. A reception will follow.

Having received his PhD from MIT in 1995, Professor Goolsbee is well known for his work on the economics of the internet, e-commerce, and the effects of new technologies generally on society. Professor Goolsbee is a Research Associate of the National Bureau of Economic Research. He has served in numerous policy positions including Chairman of the President’s Council of Economic Advisors, Chairman of the Policy Committee for the OECD, and Senior Economic Advisor to President Obama’s election campaign.

Jan 10, 2016

19th Razin Prize Awarded to PhD Student Jordan Marcusse

The Graduate Committee is pleased to announce that Jordan Marcusse is the winner of the nineteenth annual Razin Prize. Jordan received the award for his main dissertation paper entitled “Wage Bargaining and the Beveridge Curve.”. Established by the Razin family in 1997 to honor the memory of Ofair Razin (1966-1996; PhD, Georgetown University, 1996), the Razin Prize is awarded each year for the best dissertation paper produced by an advanced graduate student in Economics at GU.

The Graduate Committee is pleased to announce that Jordan Marcusse is the winner of the nineteenth annual Razin Prize. Jordan received the award for his main dissertation paper entitled “Wage Bargaining and the Beveridge Curve.”. Established by the Razin family in 1997 to honor the memory of Ofair Razin (1966-1996; PhD, Georgetown University, 1996), the Razin Prize is awarded each year for the best dissertation paper produced by an advanced graduate student in Economics at GU.

Congratulations to Jordan and to his advisers James Albrecht, Axel Anderson, Luca Flabbi, and Susan Vroman.

The Razin Economic Policy Lecture and the award ceremony will take place April 6. Details to follow soon.