Announcements

Razin Prize with Keynote Sir Timothy Besley, 3/19/26 @ 4pm, Riggs Library

February 24th, 2026

…

FOLLOW US ON X, BlueSky, and LinkedIn

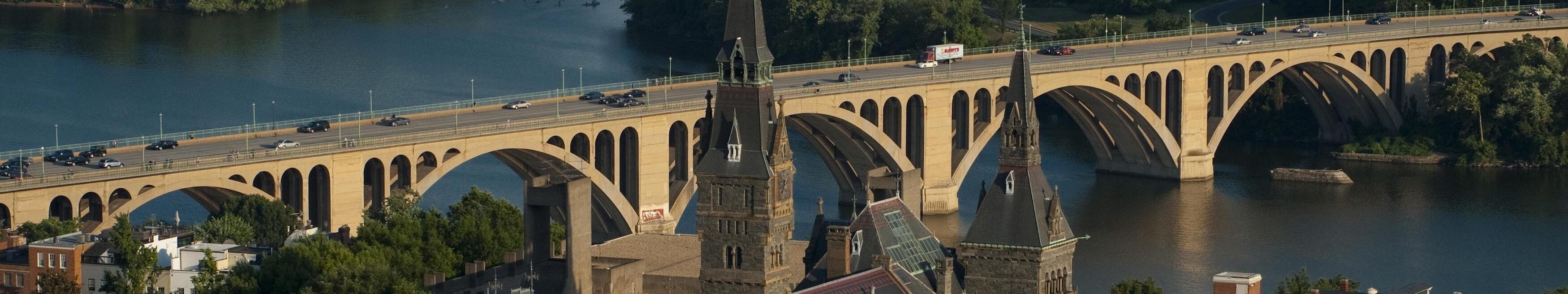

The Georgetown Center for Economic Research (GCER) is housed within the Department of Economics at Georgetown University.

Econometrics Seminar: TBDMar. 10

Applied Microeconomics Seminar: Nate MillerMar. 11

Micro Theory Seminar: Navin Kartik (Yale Univ.)Mar. 11

Development Seminar: Nishith PrakashMar. 12

Washington Area Immigration SymposiumMar. 13

Announcements

Razin Prize with Keynote Sir Timothy Besley, 3/19/26 @ 4pm, Riggs Library

February 24th, 2026

…

Announcements

Fifth DC Search & Matching Workshop – Call for Papers

November 20th, 2025

The Federal Reserve Board and the Georgetown Center for Economic Research are organizing the Fifth DC Search and Matching Workshop. The workshop will be held in person on April 17 and 18,…

Announcements

Hopkins-Georgetown Geoeconomics Conference 2026

November 18th, 2025

We invite submissions for the Hopkins-Georgetown Geoeconomics Conference April 17-18 2026. 2026 Call for Papers Submission Deadline: January 5th 2026 Submission…