Fall/Winter 2015-16

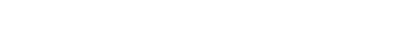

How (not) to run a bank: Georgetown economist Martin Ravallion examines World Bank success and failures.

The decade or two after WW2 saw many of the world’s poorest countries gain their independence from Colonial rule, and they were hoping to rapidly become less poor. Economics taught policy makers in those countries that a higher investment rate is crucial to assuring faster economic growth. Being a poor country makes it harder to finance the required investments from domestic savings. Yet rich countries should have ample savings available that might be profitably diverted to this task. In an ideal world, global capital markets could be expected to bridge the gap. But 70 years ago those markets were thin and/or not trusted as a source of finance.

In response, the United Nations Monetary and Financial Conference, held at Bretton Woods in 1944, created the International Bank for Reconstruction and Development (IBRD)—a core component of what came to be known as the World Bank. (The International Monetary Fund was created at the same time.) The essential idea was that the IBRD would borrow money on global markets to lend to developing countries. The Bank’s AAA credit rating (stemming from conservative lending policies relative to its capital) allowed it to lend on favorable terms. An aid-facility (with a large grant component), the International Development Association (IDA), was added in 1960.

Much has changed in the 70 years since the famous Bretton Woods conference. World Bank lending (IBRD+IDA) now represents only about 5% of the aggregate private capital flows to developing countries. In the last 10 years or so there have been prominent calls for radically reforming, or even closing, the institution on the grounds that international capital markets have developed greatly over those 70 years. It is also claimed by some that the Bank’s efforts are wasted due to poor governance in developing countries.

Does the Bank still have an important role? If so, does it fulfill that role, and if not, how might it do better? In a new paper, Professor Ravallion argue that the Bank’s development role today overlaps only partially with its original role, as conceived at the Bretton Woods Conference 70 years ago (Ravallion, 2015). Its role today is complementary to (rather than competing with) the private financial sector, other development banks, and academia. Knowledge-generation is central to that role. Development knowledge has properties of a public good, which the Bank can generate in the process of actually doing development on the ground.

Threats to the Bank’s effectiveness: There is still much appeal to the bundling of knowledge with lending that has been the distinctive feature of the Bank’s operations. But there are a number of threats to the efficacy of this model.

There have been some longstanding concerns that the Bank’s “lending culture” rewards operational staff for the volume of their lending, with only weak incentives for assuring that knowledge is both applied and generated in the lending operations. The pressure to lend influences the Bank’s ability to deliver objective policy advice to client countries, even when it is not welcome politically. Too often the Bank’s “country strategy” essentially mirrors that of the government, which may or may not serve broader long-term development goals.

Another threat is the perception that the Bank’s most powerful shareholders have excessive influence on its operations and policy advice. The U.S. has long been identified in this role, though some other countries have also been keen to have their say. Some critics are concerned (rightly or wrongly) about conflicts of interest when the Bank gives advice to developing countries.

These are threats to the Bank’s effectiveness as a knowledge leader in both the public and private sectors. All parties—both clients in developing countries and private investors—must have confidence that the institution is not pushing lending for its own sake or beholden to a few powerful owners. Only then can the Bank be accepted as the source of the objective policy advice and information that is needed.

Recent organizational changes have made some effort to put knowledge in the driver’s seat by organizing the Bank around a set of sectorally-defined “practices.” In the end the organogram has changed rather little. However, the threats to the Bank’s effectiveness are unlikely to be solved by changing the Bank’s organogram. The incentives of managers and staff also need to change, to assure a better alignment with development goals. (See Ravallion, 2015, for some examples of specific proposals for reform from past Bank staff.)

Knowledge Bank? There has been much rhetoric about the “Knowledge Bank” over the last 15 years, but Professor Ravallion not alone in believing that the reality has fallen short of the rhetoric. There is a chronic and growing underinvestment in the kind of rigorous research that is needed to identify and address pressing development issues—both the constraints on rapid poverty reduction at country level and the global public bads that threaten us collectively (ranging from climate change to pandemics). Research has been under-valued and under-funded.

Granted we still see some high-quality research at the Bank, though not always on high-priority topics. We see more ex-post evaluations today than 20 years ago. However, much does not get evaluated, and what gets evaluated is a non-random subset of all projects, casting doubt on what we learn about the whole. Too often, methodological preferences drive what gets evaluated rather than the knowledge gaps facing policy makers. Alongside this, we see fewer and less rigorous ex ante evaluations, which make explicit a project’s economic rationale—why the project is expected to have a social value justifying its cost.

Three changes are needed: Echoing the observations of others within and outside the Bank, three things need to change:

• First, the Bank needs to be more ambitious in identifying and addressing the most pressing knowledge gaps we face today. Policy advocacy must give way to well-informed and objective country-specific analysis. This can be accommodated within the Bank’s traditional country-lending model.

• Second, the Bank’s lending operations must be driven by knowledge of the binding constraints on poverty reduction in specific country contexts and its analytic capabilities must be brought more systematically into its operations from the outset. The Bank’s knowledge generation efforts must inform the nature of its lending and be informed by that lending—rather than simply serving lending when called upon. This requires quite fundamental changes in staff and managerial incentives and resource allocation within the current structure.

• Third, the Bank’s present country-based model needs to be supplemented by a model with greater capacity for supporting the provision of global public goods. If one was to sit down today to design a mechanism to support the cross-country coordination needed to address shared threats it is unlikely that one would come up with the Bank’s current country-lending model. A new model, or possibly a new institution, is called for.